When managing a business or personal vehicle, keeping a detailed record of expenses is crucial for budgeting and potentially for tax deduction purposes. Fortunately, there are several free templates and tools available to help streamline this process.

Here’s a list of the top free vehicle expense log templates, including a bonus service for those looking for a more comprehensive solution.

What are the 4 free mileage log templates for 2024?

For 2024, several online resources offer free mileage log templates that are easy to use and IRS compliant. This tool is especially useful if you drive a car for employment purposes, are self-employed and use your vehicle for business, or are an employer seeking to simplify mileage logging for your team.

Here are four free templates to help simplify tracking business expenses.

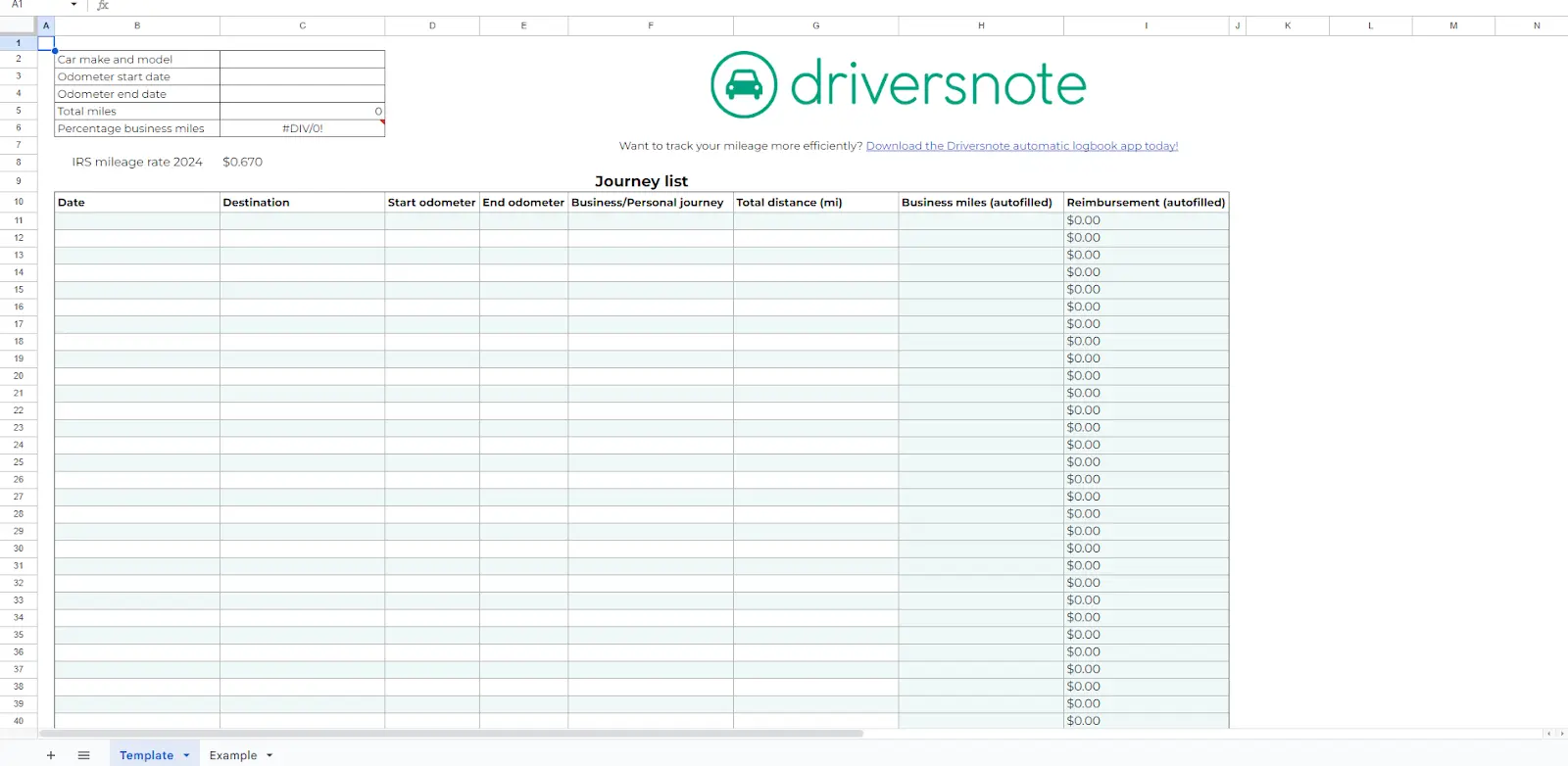

1. Driversnote IRS Printable Mileage Log Template 2024

Format: Available in PDF, Excel, and Google Sheets.

Features: Designed to simplify mileage recording with fields for date, mileage, destination, and trip purpose. It is updated with the 2024 IRS mileage rates.

Download: This template can be downloaded from the Driversnote website and is excellent for those needing a straightforward, IRS-compliant log.

Link: Driversnote Mileage Log

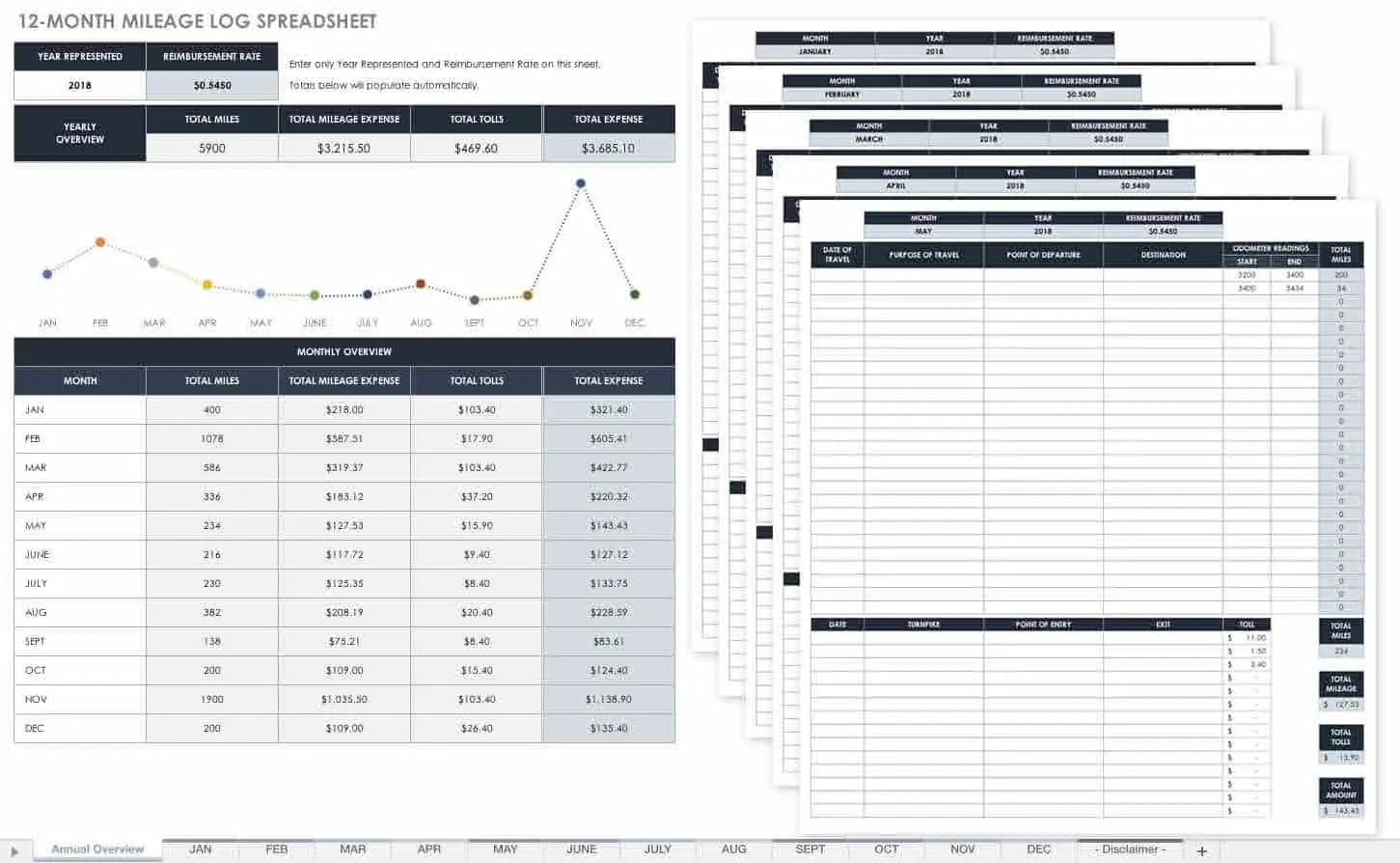

2. Smartsheet 12-Month Mileage Log Spreadsheet

Format: Available in Excel, Word, and PDF.

Features: This template allows for detailed entries, including starting and ending locations, and is daily and total miles driven. It is customizable to include other details relevant to your business.

Download: This template, accessible via Smartsheet’s template gallery, is ideal for comprehensive mileage tracking over a year.

Link: Smartsheet Mileage Log

3. GOFAR Business Mileage Tracker Form

Format: PDF or Excel

Features: This template will help you accurately record all necessary details for each business trip, such as the date, trip purpose, starting mileage, ending mileage, and any additional notes relevant to tax deductions or reimbursements.

Download: Visit the GOFAR website and search for mileage log templates. Look for the resources or blog section where they offer free templates.

Link: Go to www.gofar.co.

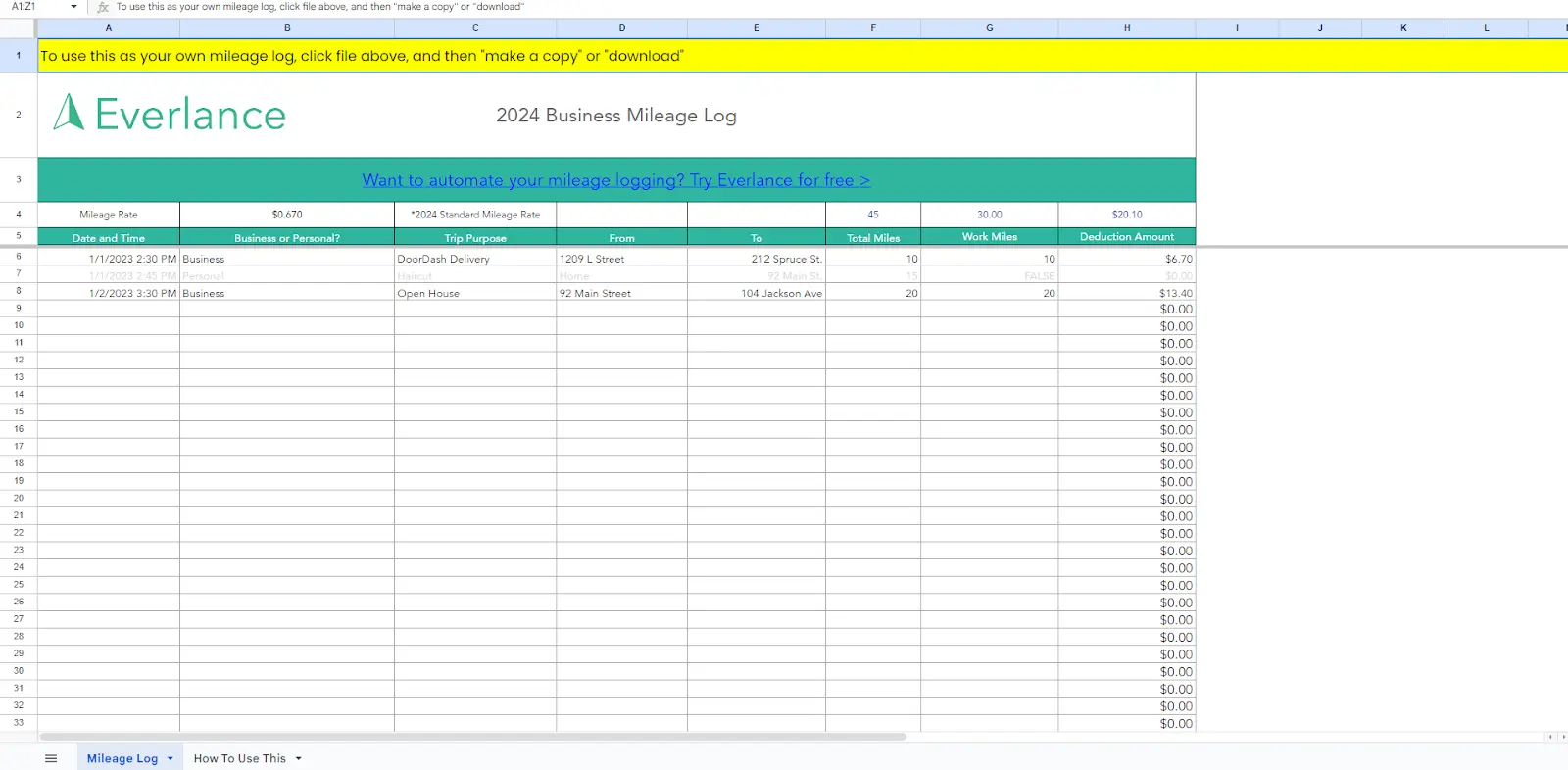

4. Everlance 2024 Free Mileage Log Template

Format: Available in Excel format.

Features: Automatically calculates deductions using the Standard Mileage Rate and includes fields for odometer readings, trip purposes, locations, etc.

Download: You can download this template from Everlance's official site. It is specifically designed to meet IRS requirements and helps in tracking mileage for tax deductions.

Link: Everlance Mileage Log

5. Bonus: Shoeboxed, an expense management service for small business owners

Shoeboxed is a receipt management service that simplifies expense tracking for business owners. It offers a streamlined approach to managing and maintaining records of all business expenses, including driving-related expenses.

Professional drivers often have many expenses on the road, such as fuel, meals, and maintenance costs.

Keeping track of all these business receipts can be a challenge, but with Shoeboxed’s Magic Envelope service, all that is needed is to stuff all receipts into the prepaid envelope provided by Shoeboxed and mail it in.

Shoeboxed’s data entry team will digitally scan, process, categorize, and organize these receipts.

So, instead of manually entering expense data, businesses can focus more. on sales and their customers.

Here’s how that would work: Keep a Magic Envelope in the seat next to you as you drive. Slip the receipt into the prepaid envelope after filling your car for gas or leaving that drive-in. Send the envelope in at the end of the month, and you won’t have to go near a spreadsheet again!

Pros

“Set and forget” expense reporting: Store your receipts in the Magic Envelope, ship them at the end of the month, and let Shoeboxed do the rest. They will scan and upload them into your account, where they will be auto-categorized.

Accurate mileage tracking can be included in expense reports.

Add multiple users to a single account for FREE.

Store digital copies of related documents for loads, including invoices, warranties, contracts, and other essential documents.

Importing e-receipts to your Shoeboxed account is as easy as syncing your Gmail with Shoeboxed, using Shoeboxed's unique Gmail Receipt Sync feature.

Integrate with other software, such as QuickBooks, for tax reporting and accounting purposes.

Used and trusted by over a million businesses.

Cons

Plans that include the Magic Envelope cannot be purchased through the mobile app.

Price

Plans that include the Magic Envelope start at $18/month, up to $54/month.

All monthly plans come with a 30-day free trial.

All annual plans are charged upon sign-up and come with a full money-back guarantee if the plan is terminated at any point within the first 30 days.

Shoeboxed is the only receipt scanner app that will handle both paper and digital receipts, saving customers up to 9.2 hours per week from manual data entry!

Hit the road with Shoeboxed 🚗

Stuff receipts into the Magic Envelope while on the road. Then send them in once a month to get scanned. 💪🏼 Try free for 30 days!

Get Started TodayWhat type of expenses should be included in a vehicle expense log?

A vehicle logbook should comprehensively capture costs associated with using and maintaining a business vehicle.

Here are the types of expenses you should consider recording:

Fuel: Keep receipts from gas station visits.

Mileage: This includes any business miles driven.

Maintenance and repairs: Regular services, unexpected repairs, and routine parts replacements.

Vehicle insurance: Monthly or annual insurance costs.

Registration fees: Yearly vehicle registration fees.

Depreciation: The loss in value of your vehicle over time, if applicable.

Other expenses: Parking, tolls, and any accessories or equipment for the vehicle.

How can a vehicle expense log be created manually in Google Sheets?

Another option is to create a vehicle expense or mileage log in Google Sheets.

Step-by-step guide:

Open Google Sheets: Start with a blank spreadsheet.

Label columns: At the top of each column, label the type of information you will record. Standard columns include Date, Description, Mileage, Fuel Cost, Gas Mileage, Maintenance Cost, Insurance, and Total Cost.

Input data: Each time you incur a vehicle-related expense, log it in the spreadsheet under the appropriate column, along with the date and relevant details.

Calculate totals: Use Google Sheets’ formulas to add totals at the bottom of each column. This will help you see what you’re spending in each category and make transferring totals over at tax time easy.

Maintain regularly: Update your log regularly to keep an accurate and ongoing record of expenses and avoid getting backlogged.

See also: Printable Expense Tracker: Top 5 Free Templates

What are the IRS mileage log requirements?

You must maintain a detailed mileage logbook to comply with IRS requirements for deducting vehicle expenses from your taxes. Whether you use the standard mileage rate or the actual expense method doesn't matter. The IRS has specific elements that must be included in your mileage log to ensure it is acceptable for tax purposes.

Key components to include in your daily mileage logs

a. Date of the trip

Record the date of each trip.

b. Mileage for each trip

Log the number of miles driven for each trip. You should note the starting and ending mileage on the vehicle’s odometer or the total miles driven for that trip.

c. Purpose of the trip

Document the specific business purpose for each trip. This should be detailed enough to justify the trip as a legitimate business expense. Personal trips and commuting expenses are not deductible.

d. Locations

Include the starting point and destination for each trip. It’s important to note specific addresses or at least the general location if specific addresses are not feasible.

e. Additional expenses

While not mandatory for the mileage deduction calculations, tracking any additional vehicle expenses related to the trip, such as tolls and parking fees, is helpful, especially if you choose to deduct actual vehicle expenses instead of using the standard mileage rate.

What are the different types of deductible mileage?

Different types of business mileage can be deducted from your taxes.

These include the following:

Business: Trips made for business purposes, excluding commuting from home to your regular place of work.

Moving: These expenses are deductible if moving purposes are for a job and meet certain distance and time requirements.

Charitable: Driving for charitable services or activities can also be deductible.

What are the IRS documentation and retention requirements?

Keep your car mileage log and other tax records for at least three years after you file your tax return or two years from the date you paid the tax, whichever is later. This is important in case of an IRS audit.

By keeping a detailed and accurate mileage log book for tax authorities, you can ensure that you comply with IRS requirements and can claim the maximum entitled tax deductions for your vehicle expenses.

Turn receipts into data with Shoeboxed ✨

Try a systematic approach to receipt categories for tax time. Try free for 30 days!

Get Started TodayFrequently asked questions

What does the IRS require for a mileage tracking log?

If you're going to deduct mileage on your taxes, the IRS requires records but doesn't specify how you keep them. You can keep a mileage log using a standard business mileage log template, a spreadsheet like an Excel mileage log template, or a mileage tracker app.

What are the benefits of keeping a mileage-tracking logbook?

Keeping a detailed record of expenses is crucial for budgeting and potentially for tax deductions.

In conclusion

Whether you go digital with a mileage tracker app or manual when tracking your small business owners' miles and other expenses, the key is ensuring every trip and expense is logged promptly and categorized correctly. This meticulous tracking ensures compliance with IRS requirements and maximizes tax deductions, ultimately benefiting your financial bottom line.

Caryl Ramsey has years of experience assisting in different aspects of bookkeeping, taxes, and customer service. She uses a variety of accounting software for setting up client information, reconciling accounts, coding expenses, running financial reports, and preparing tax returns. She is also experienced in setting up corporations with the State Corporation Commission and the IRS.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports, including IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports, and more—with Shoeboxed.

Try Shoeboxed today!